Mega Backdoor Roth Ira Limit 2024

Mega Backdoor Roth Ira Limit 2024. Every year, i max out the following: Mega backdoor is also eligible for catch up contributions of $7,000 if over 50.

You can use the following features within your 401 (k) to reach the federal limit: The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Up To $58,000 Can Be Contributed In 2021, Compared To The Standard Roth.

Hi, i'm planning to do a mega backdoor roth for the first time this year and wanted to make sure that i'm doing this correctly.

Empower Personal Cash, Budgeting Tool, Personalized Retirement Portfolios, Wealth Advisory.

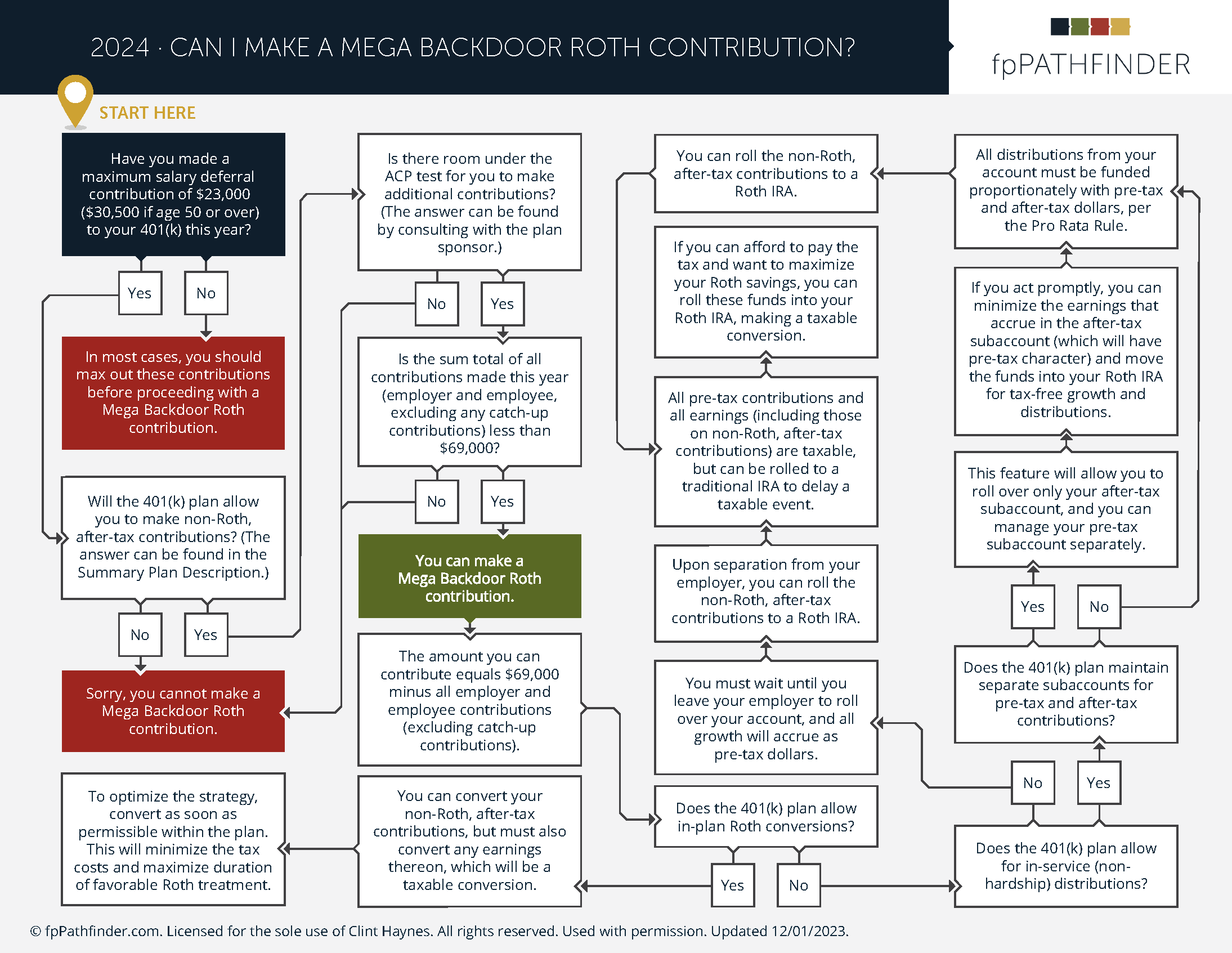

There are many moving pieces that all need to fall into place in order for this strategy to work, so we highly recommend you consult a financial advisor before trying this method.

The Strategy Can Be Helpful For Those Who Earn Too Much To Contribute Directly To A Roth Ira.

Images References :

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

How Does A Mega Backdoor Roth Work? 2024 Update!, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or contribution limits, to transfer certain types of 401(k) contributions into a roth—including a roth ira and/or roth 401(k). Empower personal cash, budgeting tool, personalized retirement portfolios, wealth advisory.

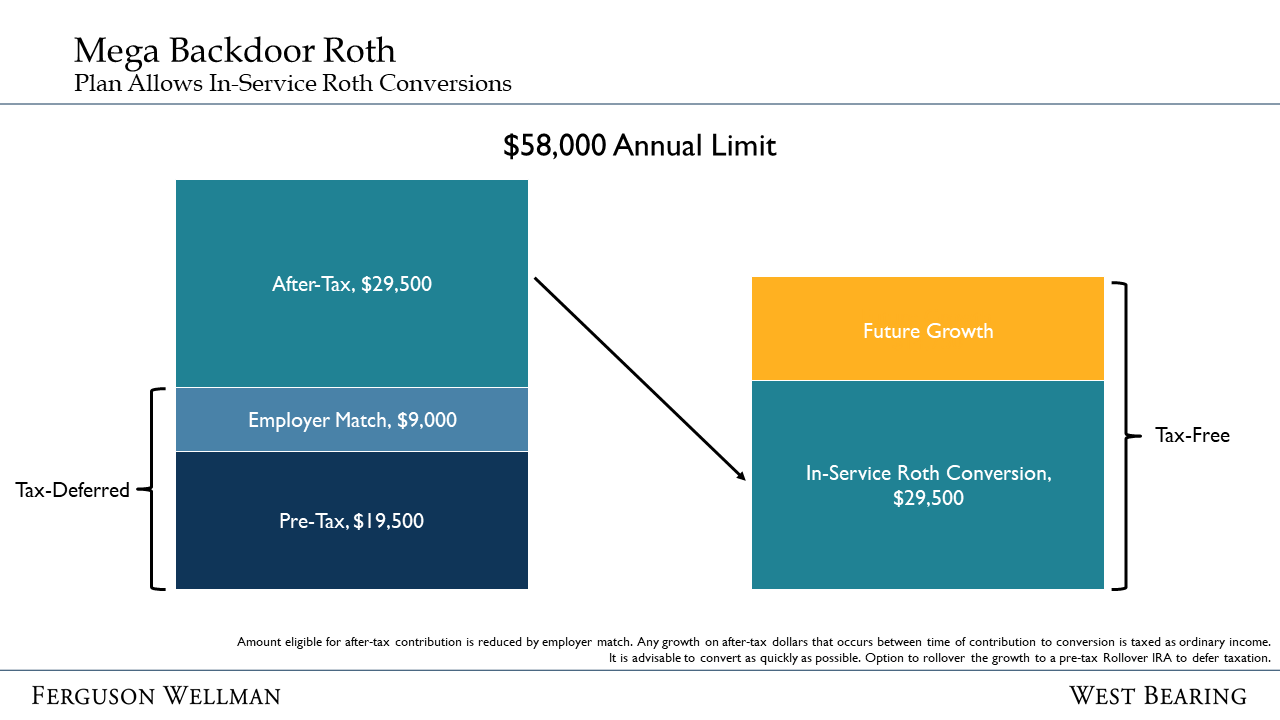

Source: www.fergusonwellman.com

Source: www.fergusonwellman.com

Backdoor and Mega Backdoor Roth Strategies — Ferguson Wellman, It’s worth it when you’re 60, so it’s more of a gift to your future self and especially if you expect to be in a higher income bracket. If your employer matched any of your yearly contributions, your mega backdoor roth amount will be that much less than $46,000.

Source: seekingalpha.com

Source: seekingalpha.com

Mega Backdoor Roth Definition & How It Works Seeking Alpha, A total contribution limit, which includes employer contributions, can reach $69,000. How much can you convert with a mega backdoor conversion in 2024?

Source: www.bitira.com

Source: www.bitira.com

Mega Backdoor Roth IRAs Explained BitIRA®, There are 2 ways to set up a backdoor roth. The cap applies to contributions made across all iras you might have.

Source: www.birchgold.com

Source: www.birchgold.com

Mega Backdoor Roth IRA A Comprehensive Guide Birch Gold Group, Anyone with income exceeding these amounts cannot contribute to a roth ira. Up to $58,000 can be contributed in 2021, compared to the standard roth.

Source: annalisewagace.pages.dev

Source: annalisewagace.pages.dev

Ira Limits 2024 Roth Dody Carleen, In 2024, the mega backdoor roth strategy allows 401 (k) contributions up to $69,000 for those under age 50 and $76,500 for people 50+. In 2021 and 2022, you could contribute up to $6,000 ($7,000 if 50 or over) per year.

Amazon Mega Backdoor Roth Sophos Wealth Management, The cap applies to contributions made across all iras you might have. The strategy can be helpful for those who earn too much to contribute directly to a roth ira.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

What is a Mega Backdoor Roth IRA?, How much can you convert with a mega backdoor conversion in 2024? Empower personal cash, budgeting tool, personalized retirement portfolios, wealth advisory.

Source: www.eaglestrong.com

Source: www.eaglestrong.com

What is the Mega Backdoor Roth IRA? Eaglestrong Financial, Roth iras have an annual contribution limit of $7,000 in 2024. The cap applies to contributions made across all iras you might have.

Source: kyrstinwhelen.pages.dev

Source: kyrstinwhelen.pages.dev

Contribution Limits Roth Ira 2024 Karie Juieta, The maximum employer + employee 401k plan contribution in 2024 is $69,000, or $76,500 if you’re age 50+ with the. There are 2 ways to set up a backdoor roth.

Up To $58,000 Can Be Contributed In 2021, Compared To The Standard Roth.

The annual contribution limit is $7,000 for 2024, plus an extra $1,000 if you’re age 50 or older.

Hi, I'm Planning To Do A Mega Backdoor Roth For The First Time This Year And Wanted To Make Sure That I'm Doing This Correctly.

If you want to fire, i think it’s less helpful.