Mileage Reimbursement 2024 Uk Gov

Mileage Reimbursement 2024 Uk Gov. What is the hmrc mileage rate for 2024 in the uk? If you are reimbursing your employees for fuel mileage on a company car, please refer to the hmrc’s advisory fuel rate calculation:.

This blog aims to offer a complete guide on everything you need to know regarding hmrc mileage reimbursement rates in 2024. (1) travelling by road includes travelling on canal banks and by steam launch or boat on rivers and canals.

Hmrc Has Announced The Revised Advisory Fuel Rates (Afr), Applicable From 1 June 2024 Until 1 September 2024.

Hmrc mileage reimbursement and claim rules for 2024/2025.

The Following Lists The Privately Owned Vehicle (Pov) Reimbursement Rates For Automobiles, Motorcycles, And Airplanes.

Based on hmrc’s current business mileage rates.

Mileage Reimbursement 2024 Uk Gov Images References :

Source: www.driversnote.co.uk

Source: www.driversnote.co.uk

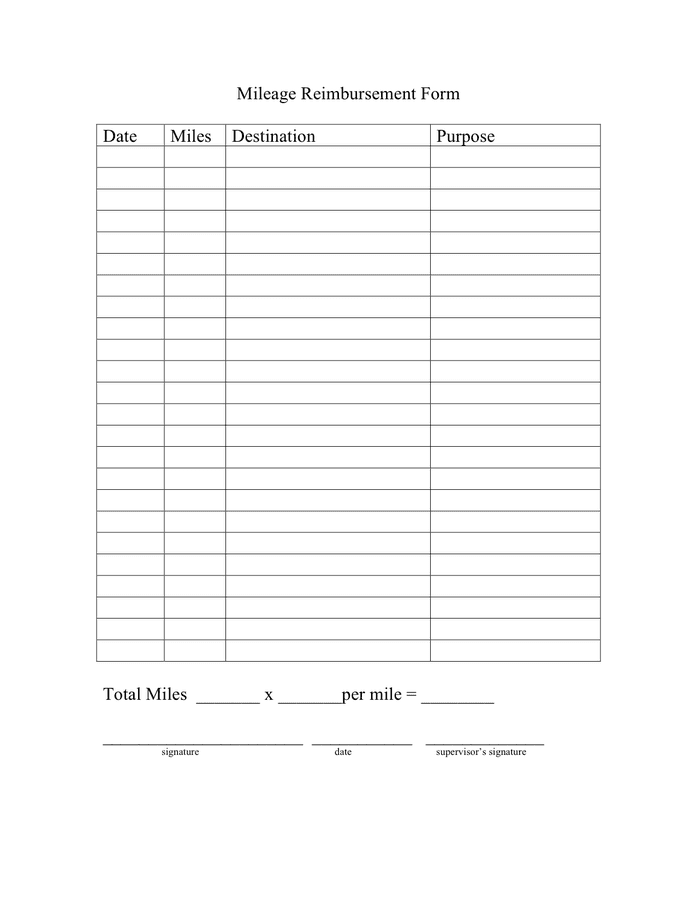

UK mileage log book template 2024 Free PDF, Sheet or Excel, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes. In this post, you can find our hmrc mileage claim calculator which calculates your mileage allowance using the mileage rate for 2023 and 2024 provided by.

Source: magavernice.pages.dev

Source: magavernice.pages.dev

Car Mileage Reimbursement 2024 Giana Babbette, In this post, you can find our hmrc mileage claim calculator which calculates your mileage allowance using the mileage rate for 2023 and 2024 provided by. Hmrc has announced the revised advisory fuel rates (afr), applicable from 1 june 2024 until 1 september 2024.

Source: codeeqloraine.pages.dev

Source: codeeqloraine.pages.dev

Irs Gas Mileage Reimbursement 2024 Andra Blanche, Mileage allowance payments ( maps) are what you pay your employee for using their own vehicle for business journeys. If you are reimbursing your employees for fuel mileage on a company car, please refer to the hmrc’s advisory fuel rate calculation:.

Source: sonnniewbriana.pages.dev

Source: sonnniewbriana.pages.dev

Employee Mileage Reimbursement 2024 Uk Nance Valenka, This blog aims to offer a complete guide on everything you need to know regarding hmrc mileage reimbursement rates in 2024. Get an overview of hmrc’s mileage rates and rules, and how to be compliant.

Source: sigridwminta.pages.dev

Source: sigridwminta.pages.dev

Going Rate For Mileage Reimbursement 2024 Eyde Oralie, Find out what you can claim for mileage for the 2024/25 tax year. Hmrc has announced the revised advisory fuel rates (afr), applicable from 1 june 2024 until 1 september 2024.

Source: georgetawelaine.pages.dev

Source: georgetawelaine.pages.dev

2024 Mileage Reimbursement Amount Calculator Annis Hyacinthie, The official hmrc business mileage rates for the tax year 2024/2025 are now confirmed, at 45p per mile for cars and vans. (2) the rates are as.

Source: magavernice.pages.dev

Source: magavernice.pages.dev

Car Mileage Reimbursement 2024 Giana Babbette, Rates and allowances for travel including mileage and fuel allowances. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred.

Source: audiqdiane-marie.pages.dev

Source: audiqdiane-marie.pages.dev

Reimburse Mileage Rate 2024 Aidan Arleyne, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred.

Source: kettyqjennilee.pages.dev

Source: kettyqjennilee.pages.dev

Irs Mileage 2024 Reimbursement Rate 2024 Heda Rachel, Find out about advisory fuel rates for company car users, when you can use them, and how they're calculated. Based on hmrc's current business mileage rates.

Source: www.itilite.com

Source: www.itilite.com

Know More about Mileage Reimbursement 2024 Rates ITILITE, Keep records of the dates and mileage of your work journeys. Rates and allowances for travel including mileage and fuel allowances.

Enter Miles This Tax Year.

Hmrc has announced the revised advisory fuel rates (afr), applicable from 1 june 2024 until 1 september 2024.

Discover The Latest Hmrc Mileage Rates For 2024 And Learn How To Easily Manage And Calculate Your Business Travel Expenses To Ensure Compliance And Fair.

The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

Category: 2024